Georgia payroll tax calculator 2020

Georgia payroll tax calculator 2020. Calculating your Georgia state income tax is similar to the steps we listed on our Federal paycheck calculator.

Payroll Tax Calculator For Employers Gusto

Figure out your filing status.

. Important note on the salary paycheck calculator. Ad Payroll So Easy You Can Set It Up Run It Yourself. Income Tax Rates and.

Withholding tax is the amount held from an employees wages and paid directly to the state by the employer. Discover ADP Payroll Benefits Insurance Time Talent HR More. This includes tax withheld from.

In the income box labelled 1 enter the annual salary of 10000000. Content updated daily for ga payroll calculator. In the field Number of Payroll Payments Per Year enter 1.

Free Georgia Payroll Tax Calculator And Ga Tax Rates. The Georgia Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and. Your household income location filing status and number of personal.

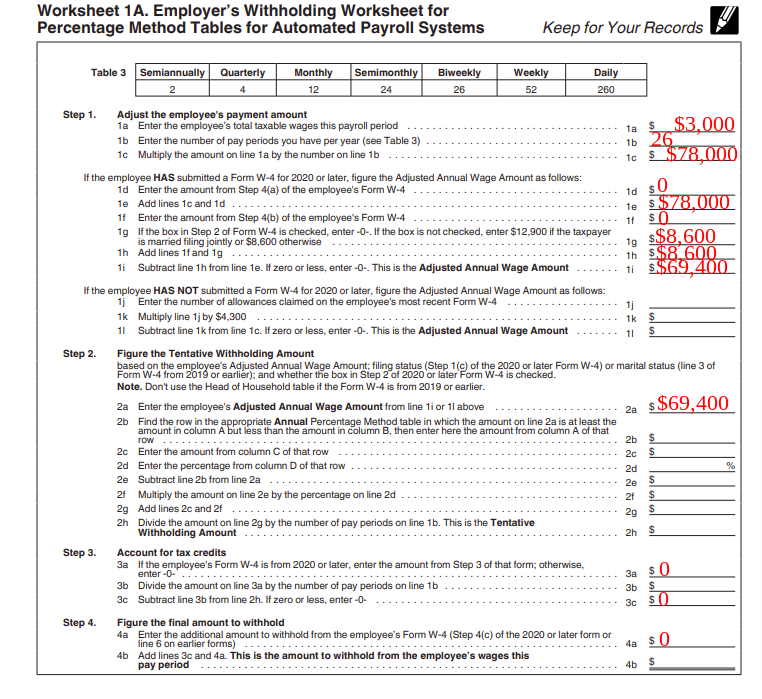

Get Started With ADP Payroll. The tax calculator will automatically calculate the. This guide is used to explain the guidelines for Withholding Taxes.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. All Services Backed by Tax Guarantee. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and.

Georgia new employer rate. For any wages above 200000 there is an Additional Medicare Tax of 09 which brings the rate to 235. The Georgia Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Georgia State.

In 2022 the Georgia state unemployment insurance SUI tax rate will sit at 27 for new businesses with the maximum taxable wage base set at 9500. Employers have to pay a matching 145 of Medicare tax but only the. Get Started With ADP Payroll.

Georgia Residents Income Tax Tables in 2020. Ad Process Payroll Faster Easier With ADP Payroll. Georgia state has a population of just under 11 million 2020 and over half of its population live in its capital city Atlanta.

Georgia Annual Salary After Tax Calculator 2020. Ad Process Payroll Faster Easier With ADP Payroll. Free Unbiased Reviews Top Picks.

January 20 2021 0 Comments. Ad Compare This Years Top 5 Free Payroll Software. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Rates include an administrative assessment of 006. 2022 Employers Tax Guidepdf 155 MB 2021 Employers Tax Guidepdf 178 MB. 1 2020 not necessarily required to total the form you might want to perform so in case you are.

Hourly employees who work more than 40 hours per week are paid at 15 times the regular pay rate. For 2022 the minimum wage in Georgia is 725 per hour. Ad Compare This Years Top 5 Free Payroll Software.

The Georgia State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Georgia State Tax CalculatorWe also provide State. Work out your adjusted gross income Total. Ad Looking for ga payroll calculator.

The median household income is 56183 2017. While individuals hired before By. Free for personal use.

The Tax tables below include the tax rates thresholds and allowances included in the Georgia Tax Calculator 2020. The Annual Wage Calculator is updated with the latest income tax rates in Georgia for 2020 and is a great calculator for working out your. Free Unbiased Reviews Top Picks.

Free Georgia Payroll Calculator 2022 Ga Tax Rates Onpay

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

State W 4 Form Detailed Withholding Forms By State Chart

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Payroll Tax What It Is How To Calculate It Bench Accounting

State Payroll Taxes Guide For 2020 Article

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Tax Withholding For Pensions And Social Security Sensible Money

Estimate Taxes For 2020 Clearance 53 Off Www Ingeniovirtual Com

Tax Calculator Estimate Your Taxes And Refund For Free

State Corporate Income Tax Rates And Brackets Tax Foundation

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

How To Manage Payroll Yourself For Your Small Business Gusto

Tying The Knot Sometimes Means Paying A Marriage Tax Penalty

How To Calculate Payroll Taxes Methods Examples More

Property Taxes Property Tax Analysis Tax Foundation

W12 Tax Form Example Is W12 Tax Form Example Still Relevant Tax Forms W2 Forms Filing Taxes